Which one is Better: Sovereign Gold Bonds or Gold+

By Gullak Team

Last updated : Jan 5, 2023

9 min read

Indians just love their gold. But it is more of a psychological love for the physical gold and not for gold as an investment. But gold has proven its mettle(!) as a good investment many times in the past.

And if you were to look at the gold price history in recent years, the investments made in gold have given stellar returns. The gold prices which were around Rs 28,000 per 10 grams around 5 years back are now at Rs 54,000! That's an average return of close to 14 percent per annum. And even if we look at the real long-term averages, then gold can deliver 9-10% returns per annum in the long term.

The wealthy HNI segment understands this benefit of gold investing and hence, invests a significant portion of their portfolio in gold. And this is what small investors also need to understand. Having gold in your investment portfolio is a must given the stellar long-term return it offers.

While in earlier years the only way to invest in gold was to buy gold coins, bars and jewellery, things have changed a lot now. There are several digital gold investment options now that track gold prices and allow for easier investment in gold. To name a few, gold ETFs, gold funds, Sovereign Gold Bond scheme (or Gold bonds) and the recently launched new option of Gold+ which offers further 4-5% more returns than normal gold.

Let's compare the popular gold bonds with new-age Gold+

What are Sovereign Gold Bonds (SGB)?

As the name suggests, these sovereign gold bonds have been launched by RBI on behalf of the Indian government and track the price of gold. So, investors who want to invest in gold and just want the price-tracking and associated appreciation can buy gold bonds.

Gold bonds have a very long lock-in period of 8 years. So it's only suitable for those who are willing to wait that long. Also, the returns that you can get from gold bonds are simply what the physical gold returns would be. It also offers a simple 2.5% interest to the bond holders which is fully taxable.

What is Gold+

Gold+ is a new digital gold option made available by Gullak. The '+' in the name is a symbol to show that it offers something extra on top of gold returns. Gold+ uses an already-established concept of gold leasing which was till now only available to the rich HNIs, to generate higher returns, in the offline physical gold market. Here the gold is leased to jewellers who will utilise it as part of their working capital. For this leasing, the jeweller pays a lease rental which generates extra returns (in gold grams itself) in addition to what gold price rise provides.

So, let's say if the gold price appreciates by 11% in a year, then Gullak's Gold+ can generate an extra 5% via lease. This results in total returns of 16% which is much higher than the gold returns you get from gold bonds.

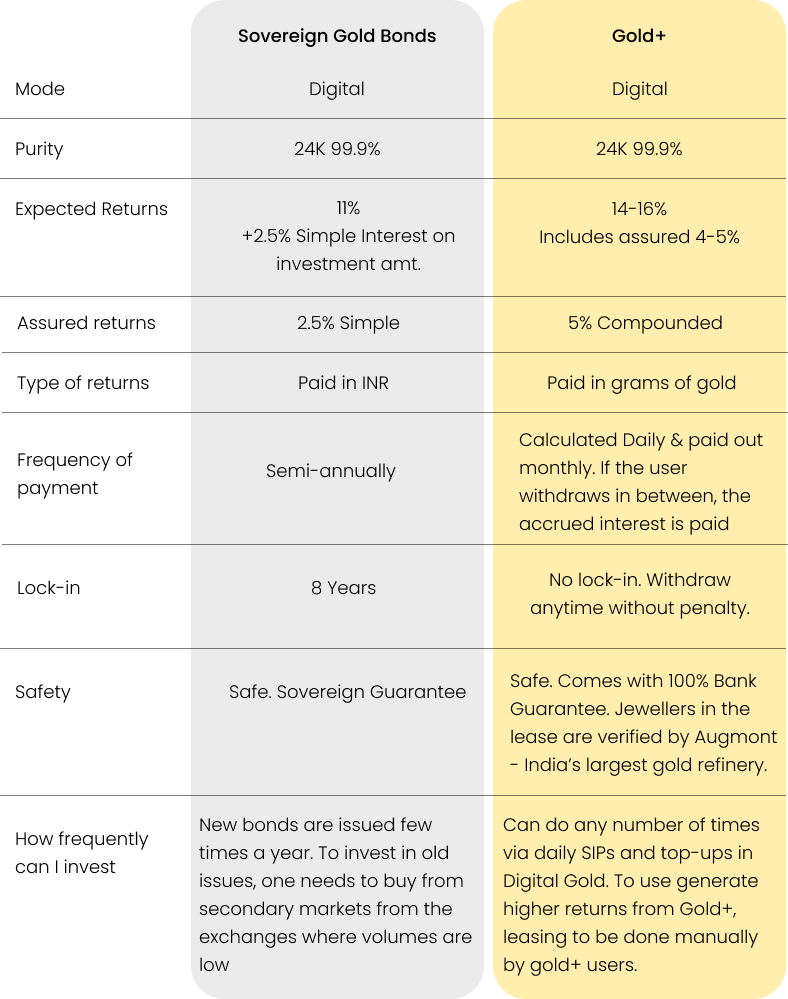

Comparison between Sovereign Gold Bonds or Gold+

While both Gold+ and Gold Bonds score over physical gold when it comes to investments, and convenience, it is the better option of Gold+ which offers higher returns than Gold Bonds to those investors who want to further increase their returns from their gold investments.

The outlook for gold prices is positive in 2023 and in future years as well. So, gold itself is expected to give high returns in the coming years. And a product like Gold+ offers extra returns over and above the gold price appreciation that increases the gold yield by an extra 5% or so.

So as an investor, if you are looking to maximise your returns from investments in gold, then having Gold+ by Gullak in your portfolio is a wise thing to do. You get the safety of gold and extra returns on top of it.

Frequently Asked Questions

What is meant by daily savings?

What is save on every spend feature? How can I activate it?

Can I make a one-time/lump sum investment?

What is digital gold?

Is Gullak safe?

Can I withdraw my money anytime I want?